As a small business owner, it’s important to always think ahead. First and foremost, before you start making plans and strategizing, you need to make sure your small business finances are in order. Perhaps in the next quarter you would like to expand a business location, purchase more inventory, or hire additional employees. These are great goals to set and will likely benefit your business. Unfortunately, if you don’t know if you can afford these plans, it will be difficult to implement them. In this article, we’ll give you seven strategies to make sure your finances are bigger and better in the year ahead!

Reevaluate your budget

As you prepare your business for another year, you should review your budget and see if any revisions need to be made. Updating your business budget frequently will allow you to manage your finances responsibly and confirm that you are spending them on the things your business needs. Plus, it’ll probably keep you from overspending!

Reduce unnecessary costs

After reviewing your small business budget, determine where you are overspending. It can be marketing initiatives that don’t generate leads, or the purchase of excess inventory that is wasted. Whatever those costs are, it’s likely that your company’s money could be put to better use.

Get ready for tax season

Why not get a head start by compiling all the necessary forms and information you’ll need to file your business taxes? Check deadlines, make sure financial reports are up to date, and separate business from personal statements. If you get ahead now, you’ll be stress-free when April rolls around.

Don’t forget the discounts

There are many discounts and programs that small business owners can take advantage of! Make your savings easier by using websites, which offer a wide range of deals to choose from. Joining a trade organization for professionals in your industry can also be beneficial. Many of these associations offer their members discounted rates for office supplies, travel sites, and other business-related expenses. You’ll get valuable networking opportunities and save money in the process: it’s a win-win!

Set goals and tackle them

Almost everyone swears to accomplish goals at the start of the new year. Unfortunately, many people lose sight of the rewards that come with finishing what they started in a matter of weeks or months. It can be hard to stay honest when working on something and this is no exception for small business owners. Maybe you want to save to open an additional location or do you want to double your turnover compared to the previous year? To realize these ideas, you will need the necessary finances. Write down your financial goals and develop a plan. Then share it with a few trusted colleagues! They will be able to hold you accountable and encourage you along the way.

Think about seasonal changes

If you’re running a seasonal business, it’s especially imperative to consider the low season, when you’re not producing sales. Start thinking about ways to make extra money during the off season, keep a list of tasks you need to complete before the next season opens, and consider the costs that will go into making those preparations. You will thank yourself when opening day arrives and you feel financially secure.

Consider applying for working capital

If you have projects you’d like to get started in the new year, or just want some extra cash, your business could benefit from applying for additional working capital. Make sure you have your monthly sales volume and other important financial information ready to provide to a creditor. Again, being organized will definitely help speed up this process, and it will be less hectic than chasing a bank loan! It’s a new year, but that doesn’t mean you have to fall back into previous bad habits. By taking control of your small business finances now, you’ll be able to set the tone for a strong 2022.

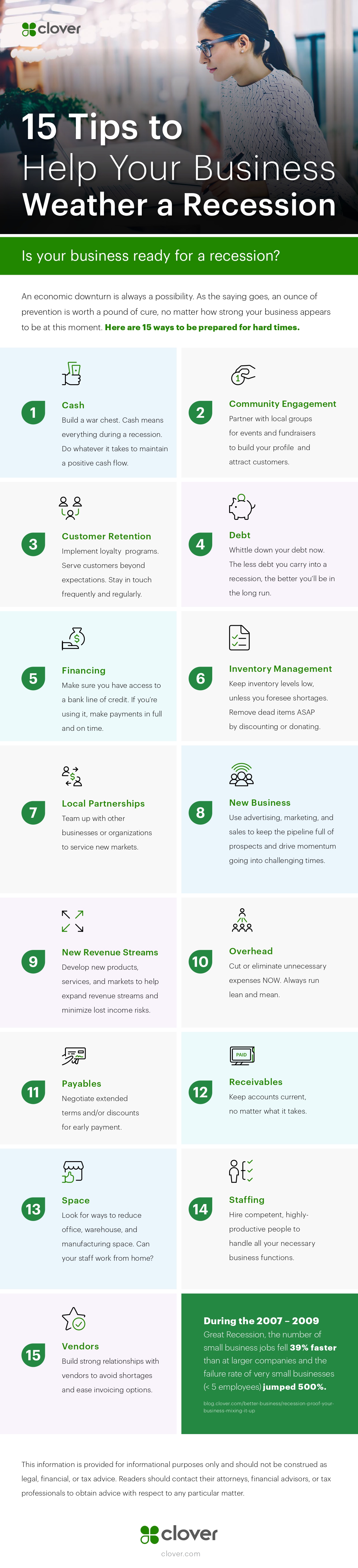

Infographic Created by Clover, Best All-in-One Retail POS System to Help Streamline Your Store